Textile Machinery Industry: In the Triangle of Growth, Innovation and Sustainability

According to a Fortune Business Insights report, the global textile machinery market was projected to reach $52.39 billion in 2024. The market is expected to grow from $55.28 billion in 2025 to $83.49 billion by 2032, achieving a compound annual growth rate (CAGR) of 6.1% during the forecast period.

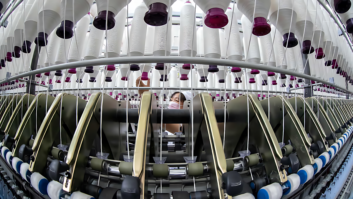

The Textile Machinery is Evolving with the Rise of Emerging Economies

The textile machinery market is currently experiencing a transformative phase, driven by advancements in technology and increasing demand for sustainable practices. Factory investments increasingly revolve around Industry 4.0 tools that counter skilled-labor shortages and raise uptime. Smart sensors, cloud analytics, and AI-driven defect detection push equipment upgrades, while recycling mandates spur orders for automated sorting and fiber-to-fiber systems. Technical-textile demand in medical, protective, and sporting goods continues to outpace traditional apparel, opening fresh profit pools. Cost-efficient synthetic fibers and bio-based alternatives both lift machinery sales, and tariff-induced near-shoring in the Americas accelerates orders for flexible, low-lot production lines.

Smart Technologies and Automation Are Reshaping the Textile Machinery Market

The need to increase production efficiency is accelerating the transition to smart technologies in the textile industry. Machines equipped with IoT and AI significantly reduce downtime and costs through real-time monitoring and predictive maintenance. The proliferation of automated weaving and knitting machines is supporting this transformation by increasing both precision and production speed. The smart textile machinery market is expected to grow approximately 15% annually, indicating that manufacturers will continue to invest in advanced technologies.

The need to increase production efficiency is accelerating the transition to smart technologies in the textile industry. Machines equipped with IoT and AI significantly reduce downtime and costs through real-time monitoring and predictive maintenance. The proliferation of automated weaving and knitting machines is supporting this transformation by increasing both precision and production speed. The smart textile machinery market is expected to grow approximately 15% annually, indicating that manufacturers will continue to invest in advanced technologies.

Fully Automatic Systems to Grow 6.91% by 2030

The fact that semi-automated platforms accounted for 43.45% of the market in 2024 demonstrates the continued balance between labor costs and automation costs. While these machines still require an operator, they optimize processes through sensor-based tension and speed control. Meanwhile, the transition to fully automated systems is accelerating. IoT-connected panels and AI-powered vision technologies are providing significant time savings in production.

Industry 4.0-ready fully automated systems are projected to grow at a CAGR of 6.91% by 2030. Factories are shifting to more closed-circuit production models, requiring less human intervention, due to the pressures of a shortage of technical personnel. While manual machines remain prevalent in low-wage regions, they are losing share as wage inflation rises. In this process, suppliers are offering modular upgrades, such as robotic tool changers, to enable businesses to transition to automation without revamping entire lines.

These developments clearly demonstrate that smart systems will play a decisive role in the future of the textile machinery market.

Demand for Sustainable Textiles is Increasing

The increasing consumer awareness regarding environmental issues appears to drive the Textile Machinery Market towards sustainable practices. Manufacturers are now focusing on eco-friendly materials and processes, which necessitates advanced machinery capable of producing sustainable textiles. The market for sustainable textiles is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This shift not only aligns with consumer preferences but also encourages manufacturers to invest in innovative machinery that reduces waste and energy consumption. As a result, the demand for textile machinery that supports sustainable production methods is likely to rise, indicating a significant trend within the Textile Machinery Market.

Customizable Textile Machinery Market Growth Rate to Reach 10%

Consumers are increasingly seeking unique designs and personalized textiles, prompting manufacturers to adapt their production processes. This shift necessitates machinery that can handle small batch sizes and diverse fabric types efficiently. As a result, the market for flexible and customizable textile machinery is projected to expand, with growth rates potentially reaching 10% in the coming years. This trend suggests that manufacturers who invest in adaptable machinery will likely gain a competitive edge, further propelling the evolution of the Textile Machinery Market.

Consumers are increasingly seeking unique designs and personalized textiles, prompting manufacturers to adapt their production processes. This shift necessitates machinery that can handle small batch sizes and diverse fabric types efficiently. As a result, the market for flexible and customizable textile machinery is projected to expand, with growth rates potentially reaching 10% in the coming years. This trend suggests that manufacturers who invest in adaptable machinery will likely gain a competitive edge, further propelling the evolution of the Textile Machinery Market.

Rising Clothing Consumption in Emerging Economies Supports the Textile Machinery Market

Rising clothing consumption in emerging economies is becoming a key driver of growth in the textile machinery market. Cotton yarn manufacturers in India expect revenue growth of 7–9% in fiscal 2025, driven by recovering demand in China and the expansion of the local retail market. Favorable yarn distribution and improved cotton supply are supporting mills’ capacity expansion and modernization investments.

Similarly, demographic growth in ASEAN countries and Africa is creating new capacity needs for spinning and knitting lines. Tariff-induced fluctuations in global supply chains are forcing brands in these regions to scale, while demand for affordable yet modern machinery is increasing. Therefore, flexible financing solutions and modular machinery upgrades are becoming increasingly critical selling points for suppliers.

The growth of the fashion and apparel industry is also providing strong impetus to this process. Rapid changes in global fashion trends and innovation-driven designs are increasing the importance of advanced machinery capable of efficiently producing higher-quality fabrics. The approximately 5% annual growth in the ready-to-wear market makes it inevitable for textile manufacturers to turn to modern equipment to remain competitive.

All these developments indicate that the strong synergy between the fashion sector and the textile machinery industry will become even more evident in the coming period, and emerging markets will play a critical role in this growth.

Countries with Growing Economies Are Investing More in Textiles

Emerging markets are experiencing rapid economic development, which seems to be positively impacting the Textile Machinery Market. Countries with growing economies are increasingly investing in their textile sectors, leading to heightened demand for modern machinery. For instance, regions in Asia and Africa are witnessing a surge in textile production capabilities, with investments in machinery expected to rise by approximately 12% over the next few years. This trend indicates that as these markets develop, the demand for efficient and advanced textile machinery will likely increase, thereby driving growth within the Textile Machinery Market.

Emerging markets are experiencing rapid economic development, which seems to be positively impacting the Textile Machinery Market. Countries with growing economies are increasingly investing in their textile sectors, leading to heightened demand for modern machinery. For instance, regions in Asia and Africa are witnessing a surge in textile production capabilities, with investments in machinery expected to rise by approximately 12% over the next few years. This trend indicates that as these markets develop, the demand for efficient and advanced textile machinery will likely increase, thereby driving growth within the Textile Machinery Market.

High Capital Investments May Hinder Market Growth

One of the most significant factors limiting the growth of the global textile machinery market is the high capital investment required for modern and technologically advanced machinery. New-generation textile machinery, equipped with automation, digitalization, and sustainability-focused features, poses a significant financial burden for both established manufacturers and new entrants due to their high price tags. Small and medium-sized enterprises (SMEs), in particular, struggle to access the financing necessary for these investments and thus struggle to maintain their competitiveness in this rapidly evolving market.

This situation becomes even more pronounced for large-scale investments, such as complete spinning or weaving lines. Some lines can cost over $10 million, and this level of capital requirement poses a significant obstacle, especially for medium-sized factories. Furthermore, the rapidly shortening technology cycles necessitate careful calculation of the return on investment (ROI); for example, state-of-the-art ring spinning machines can be at risk of technical obsolescence even before their payback period is complete.

Macroeconomic uncertainties further reduce investment appetite. During periods of budget freezes, orders are significantly reduced; indeed, orders from Italian OEMs decreased by 16% in 2023. Exchange rate fluctuations further weaken purchasing power by increasing the cost of imported equipment in regions like South Asia and Africa.

To address these challenges, suppliers are shifting to offering solutions that reduce cost and limit technological dependency. Trade-in programs, flexible financing packages, and modular upgrades that can be added to existing lines are becoming important alternatives, particularly for SMEs. However, despite all this support, the high initial capital requirement remains one of the biggest obstacles facing the sector in transitioning to modern textile machinery.

Raw Material Cost Volatility Affecting Budgets

Cotton and polyester price swings distort cash planning and cloud CAPEX decisions. Trade actions such as U.S. antidumping reviews on polyester yarn add uncertainty that discourages equipment commitments. Energy remains another volatile input, with dyeing lines soaking up steam and electricity. Turkish mills that installed solar heat cut summer energy bills by 60%, signaling that efficiency upgrades reduce exposure. Machines capable of processing multiple fiber types give operators flexibility to pivot toward the lowest-cost input mix.

Technical Textiles Rises to Leadership in Innovation

In 2024, the ready-to-wear and apparel segment held the largest share of the textile machinery market, at 62.45%. While fast fashion volumes are keeping demand for ring-spun yarn, air-jet weaving, and knitting machines buoyant, increasing cost pressures are driving manufacturers toward more value-added areas. Digital color management, on-demand production, and software-hardware integration systems are prominent in this transformation.

In 2024, the ready-to-wear and apparel segment held the largest share of the textile machinery market, at 62.45%. While fast fashion volumes are keeping demand for ring-spun yarn, air-jet weaving, and knitting machines buoyant, increasing cost pressures are driving manufacturers toward more value-added areas. Digital color management, on-demand production, and software-hardware integration systems are prominent in this transformation.

In this environment, technical textiles have become the fastest-growing and innovation-driven segment of the industry. Technical textile facilities are expected to grow at a CAGR of 6.7% by 2030, with the market reaching $346.67 billion from $225.99 billion. This expansion is significantly increasing demand for specialized machinery capable of processing nanofibers, composite structures, and smart fabrics.

Melt-blown lines, which gained importance during the pandemic, demonstrated technical textiles’ ability to quickly adapt to regulations. Today, the sector is turning to electrospinning systems for sensor-integrated fabrics, 3D weaving machines used in sports, and equipment capable of producing conductive yarn. These high-tech lines also offer stronger profitability.

Sports brands’ shift towards composite and bio-based materials is increasing interest in advanced weaving and knitting technologies, while recycling mandates are also expanding the use of recycled fibers in technical applications. European and US manufacturers are strengthening their market positions by focusing on high-margin areas such as protective equipment.

All these developments promise long-term, stable, and sustainable growth for technical textile machinery manufacturers.

Synthetic Fibers Drive Growth

Synthetic fiber processing equipment accounted for 60.56% of the textile machinery market in 2024. Polyester’s cost advantages and diverse performance are driving demand for technologies like air-gap wet spinning and low-shear melt extruders. Rapid color change systems, meanwhile, are adapting to e-commerce’s small-batch production trend and reducing waste. Cotton, on the other hand, is experiencing slower growth due to limited planting areas and water usage pressures.

Synthetic lines are also one of the fastest-growing segments. Solution spinning innovations are reducing energy consumption, and the market is expected to grow at a CAGR of 6.09% by 2030. Hybrid machines capable of processing bio-based polyesters, chemically recycled PTA, and both virgin and recycled raw materials are gaining prominence. These hybrid solutions make it easier for manufacturers to meet their sustainability goals. While machines for bast fibers like hemp and flax are receiving support in the EU, the segment still holds a limited share due to scale constraints.

Near-shoring & Tariff-driven Capacity Relocation

The universal 10% U.S. import tariff introduced in April 2025 shifted sourcing away from Vietnam and China toward Mexico and Central America. Brands close to U.S. consumers now value speed and lower inventory over pure labor arbitrage. Regional trade incentives and recycling tax credits sweeten machinery purchases in the Western Hemisphere. European players in Turkey and Germany likewise lure buyers seeking premium fabrics unaffected by Asian duties. Equipment makers respond by expanding service centers and stocking spares closer to new hubs.

Market Dominance in Spinning Machines

Spinning equipment accounted for 44.36% of the textile machinery market share in 2024, underscoring its central role in yarn conversion. Global installed short-staple spindle capacity hit 232 million units, and replacement demand remains steady as mills chase higher speed and lower breakage. Rieter’s draw-frame patent win and Trützschler’s 12-head comber that lifts output 50% illustrate how OEMs defend margins through innovation. Weaving and knitting machines follow as core pillars but face slower growth relative to recycling shredders, digital printers, and bio-fiber extruders.

Spinning equipment accounted for 44.36% of the textile machinery market share in 2024, underscoring its central role in yarn conversion. Global installed short-staple spindle capacity hit 232 million units, and replacement demand remains steady as mills chase higher speed and lower breakage. Rieter’s draw-frame patent win and Trützschler’s 12-head comber that lifts output 50% illustrate how OEMs defend margins through innovation. Weaving and knitting machines follow as core pillars but face slower growth relative to recycling shredders, digital printers, and bio-fiber extruders.

Other machine categories, while smaller, are set to post a 6.82% CAGR to 2030. Investors favor recycling lines that separate cotton and polyester streams or dissolve blended fabrics chemically. Specialty looms that weave basalt or aramid for automotive composites also gain traction. As apparel cycles compress, direct-to-garment printers that deliver one-off designs create new revenue for machinery vendors willing to straddle textile and digital domains. The broadening equipment menu positions suppliers to chase diverse cash flows rather than rely solely on commodity yarn systems.

Asia-Pacific: Emerging Market Potential

Asia-Pacific, driven by increasing industrialization and a growing consumer base, is becoming one of the fastest-growing regions in the textile machinery market. By 2024, the region accounted for 55.56% of global market demand, driven by China’s extensive installed base and India’s seven-park PM MITRA program, valued at $535 million. Government initiatives to increase production capacity and strengthen exports are driving significant growth in demand for advanced and modern textile machinery.

The strong presence of major manufacturers such as Shima Seiki and Tsudakoma in the region makes China the largest market in Asia-Pacific. The competitive landscape is characterized by a mix of local companies offering cost-effective solutions and international companies focusing on technological innovation. Continued investments in modernization and innovation suggest that demand for innovative textile machinery in the region will continue to grow rapidly in the coming years.

North America: Innovation and Sustainability Focus

North America is a significant player in the textile machinery market, driven by technological advancements and a strong emphasis on sustainability. The region holds approximately 30% of the global market share, making it the largest market. Regulatory support for eco-friendly practices and innovations in automation are key growth drivers, enhancing production efficiency and reducing environmental impact. The United States and Canada are the leading countries in this region, with a competitive landscape featuring major players like Truetzschler and Rieter. The presence of advanced manufacturing facilities and a skilled workforce further bolster the market. Companies are increasingly investing in R&D to develop cutting-edge machinery that meets evolving consumer demands and regulatory standards.

Europe: A Marketplace Blending Heritage and Modernization

Europe is a vital region for the textile machinery market, characterized by a blend of heritage and modernization. It accounts for around 25% of the global market share, making it the second-largest market. The region benefits from stringent regulations promoting sustainability and innovation, driving demand for advanced textile machinery that meets high-quality standards. Countries like Germany, Switzerland, and Italy lead the market, with key players such as Saurer and Itema. The competitive landscape is marked by a focus on high-tech solutions and automation, enabling manufacturers to enhance productivity. European firms are also increasingly collaborating with research institutions to foster innovation and maintain their competitive edge in the global market.

Middle East and Africa: Resource-Rich and Rapidly Growing Markets

The Middle East and Africa, with their abundant resources and increasing investments in manufacturing, offer unique opportunities in the textile machinery market. While the region accounts for approximately 15% of the global market, it is increasingly focusing on local manufacturing capacity. Government initiatives aimed at diversifying their economies and increasing industrial production are among the key drivers of market growth.

The Middle East and Africa, with their abundant resources and increasing investments in manufacturing, offer unique opportunities in the textile machinery market. While the region accounts for approximately 15% of the global market, it is increasingly focusing on local manufacturing capacity. Government initiatives aimed at diversifying their economies and increasing industrial production are among the key drivers of market growth.

Countries like South Africa and Egypt offer a dynamic environment where both local and international players compete. Trade diversification is driving orders to Egypt, Morocco, and Ethiopia, bringing the region to the forefront. Gulf investors are financing integrated polyester plants based on low-cost energy, which is driving demand for texturing and warp-knitting lines. Meanwhile, factories in Africa are leveraging AGOA and EU trade preferences to secure garment contracts shifted from Asia.

Equipment suppliers are partnering with local universities and developing training programs to address the region’s operator shortage and skills gap. Driven by these developments, the Middle East and Africa is expected to be one of the fastest-growing regions in the textile machinery market, with a compound annual growth rate of 6.47% by 2030.

Key Players’ Strategies and the Future of the Market

The Textile Machinery Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and increasing demand for sustainable production methods. Key players such as Truetzschler (Germany), Rieter (Switzerland), and Picanol (Belgium) are at the forefront, each adopting distinct strategies to enhance their market positioning. Truetzschler (Germany) focuses on innovation in spinning technology, aiming to improve efficiency and reduce energy consumption. Rieter (Switzerland) emphasizes digital transformation, integrating smart technologies into their machinery to optimize production processes. Picanol (Belgium) is actively pursuing regional expansion, particularly in Asia, to capitalize on the growing textile manufacturing base in that region. Collectively, these strategies contribute to a competitive environment that is increasingly centered around technological prowess and sustainability.

In August 2025, Rieter (Switzerland) announced the launch of a new digital platform designed to enhance customer engagement and streamline service processes. This strategic move is pivotal as it aligns with the growing trend towards digitalization in the textile machinery sector, allowing Rieter to offer tailored solutions and improve customer satisfaction. The platform is expected to facilitate real-time data sharing, thereby enhancing operational efficiency for clients.

In September 2025, Picanol (Belgium) unveiled a new line of weaving machines that incorporate AI-driven features for predictive maintenance. This development is significant as it not only showcases Picanol’s commitment to innovation but also addresses the industry’s increasing focus on minimizing downtime and optimizing production efficiency. By leveraging AI, Picanol positions itself as a leader in smart manufacturing solutions, potentially reshaping customer expectations in the weaving segment.

In July 2025, Truetzschler (Germany) entered into a strategic partnership with a leading textile research institute to develop sustainable fiber production technologies. This collaboration is indicative of the industry’s shift towards sustainability, as it aims to create more eco-friendly production processes. By aligning with research institutions, Truetzschler enhances its innovation capabilities and reinforces its commitment to sustainability, which is becoming a critical factor for competitive differentiation in the market.

Competition centers on a handful of global players with deep R&D pipelines and broad service networks. Rieter, Trützschler, and Saurer guard market share through patented drafting, combing, and rotor-spinning modules. Asian challengers grow volume in mid-range segments but still trail in high-speed, fully automated offerings. OEMs increasingly bundle software, sensors, and analytics, moving toward platform revenues rather than one-off machine sales.

Strategic moves in 2024-2025 highlight consolidation and diversification. Toyota’s proposed USD 42 billion bid for Toyota Industries would reunite the automotive giant with its long heritage, pooling cash flow and electronics know-how. Lectra reported 173% SaaS growth as 3D-pattern software subscriptions locked clients into recurring contracts. ANDRITZ and Sulzer transferred filtration and pump expertise into textile recycling lines, entering higher-growth adjacencies while leveraging existing process-engineering strengths.

As of October 2025, the Textile Machinery Market is witnessing trends that emphasize digitalization, sustainability, and the integration of AI technologies. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise to address complex challenges. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technological advancement, and supply chain reliability, reflecting the industry’s response to changing consumer demands and environmental considerations.